How to Buy a Used Car: Inspection, Pricing, and Negotiation Tips

Outline and Why Used Cars Remain a Smart Move

Before diving into listings, it helps to know where you’re headed. This article follows a clear path from preparation to purchase, with each step building on the last so you can move from curiosity to a confident handshake. Here is the roadmap we’ll follow, along with why each step matters for both your wallet and your peace of mind.

Outline at a glance:

– Section 1: A practical overview of why used cars often deliver strong value, plus the full learning path you’ll take.

– Section 2: Research and budgeting, including needs analysis, financing choices, and search filters that save time.

– Section 3: Inspection and test-drive checklists that reveal condition, safety, and potential repair costs.

– Section 4: Pricing and valuation methods, with total cost of ownership to avoid budget surprises.

– Section 5: Negotiation, paperwork, and post-purchase steps for a smooth, secure finish.

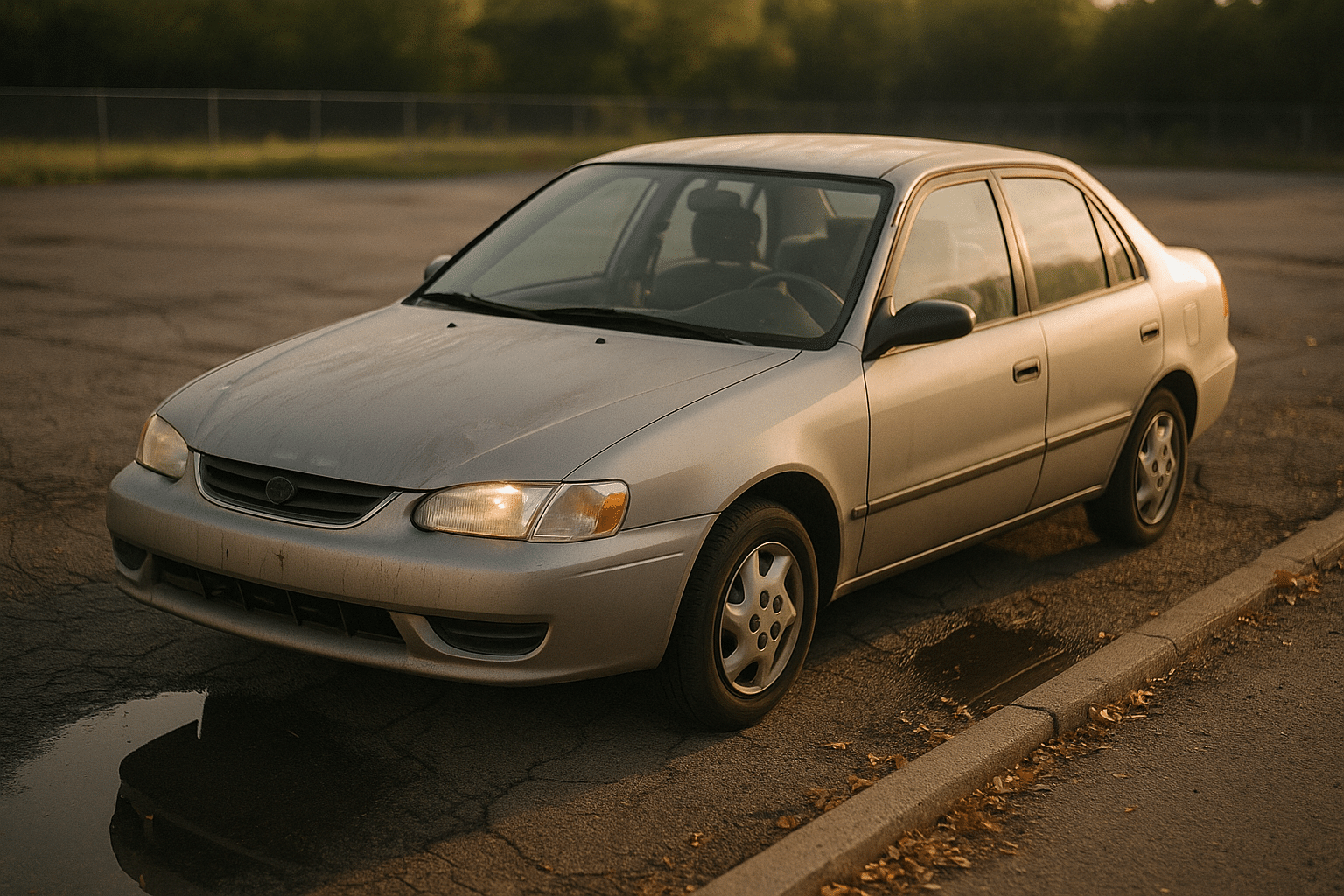

Why used cars? Depreciation does much of the heavy lifting for you. New vehicles commonly lose about 20–30% of value in the first year and roughly 50% by year five, depending on segment, mileage, and condition. That means a well-chosen used vehicle can deliver comparable utility at a significantly lower entry price. Many models also stabilize in depreciation after the steep early drop, so the value curve can feel gentler for the next owner. Another advantage is selection: you’re not limited to a current model year, so you can hunt features, trims, or body styles that fit your life, rather than fitting your life around a narrow new-car inventory.

Market context matters. After sharp swings in recent years, many regions have seen used inventory improve and days-on-market rise, giving buyers more leverage. However, interest rates and local demand still shape what’s negotiable. The rest of this guide helps you read those signals, separate gems from guesswork, and craft offers anchored in facts—not hope. Think of it as your road atlas: a blend of data, practical tips, and a little storytelling to keep the drive lively.

Research and Budgeting: Define Needs, Set Limits, Find Candidates

Start by deciding what you actually need the car to do. Daily commuting, weekend hauling, long-distance efficiency, or a mix? Your use case determines fuel type, body style, cargo capacity, and long-term costs. Be specific: number of seats required, highway versus city mileage patterns, driveway or street parking constraints, and any must-have safety or convenience features. A focused profile turns a sea of listings into a manageable short list.

Build a realistic budget before you fall in love with a shiny listing. Consider:

– Purchase price: the headline number, but only a starting point.

– Taxes, registration, and title fees: often 6–12% combined, depending on location.

– Insurance: request quotes based on the vehicle’s VIN, not estimates.

– Pre-purchase inspection: plan roughly $120–$250 for an independent check.

– Immediate maintenance: set aside a cushion (often 5–10% of the price) for tires, brakes, fluids, or a battery.

– Fuel: estimate using your annual miles (many drivers average 12,000–15,000 miles) and the vehicle’s real-world economy.

– Financing: compare offers from a bank or credit union versus a dealership; seek preapproval so you know your ceiling.

Financing details can make or break a “deal.” A lower price paired with a higher rate may cost more over time. Run scenarios at multiple APRs and terms; a shorter term usually reduces interest paid but increases the monthly commitment. Aim for a down payment that keeps your loan-to-value ratio comfortable and helps you avoid owing more than the car is worth if you need to sell. If you can pay cash, keep an emergency fund intact to cover unforeseen repairs without stress.

Next, zero in on candidates. Cast a net that includes local dealers, private-party listings, and auction-style platforms with buyer protections. Use filters wisely: set mileage caps aligned with your comfort zone, model years that avoid known problem ranges, and features that truly matter. Look for patterns in asking prices to identify outliers. Save five to eight promising options so you can compare condition notes, mileage, and histories side by side. A structured search may feel slower at first, but it quickly pays off by steering you toward vehicles worth your time and away from distracting maybes.

Inspection and Test Drive: A Step-by-Step Checklist That Saves Money

Think of the inspection as detective work. The goal is not to find a “perfect” car, but to understand exactly what you’re buying and what it may need soon. Begin with the paperwork: ask for maintenance records, receipts for recent work, and a vehicle history report from a reputable provider. Compare the VIN on the title with the VIN plates on the dash and door jamb. Title brands like salvage, rebuilt, or flood should trigger careful scrutiny or a polite pass.

Walk-around checklist:

– Body panels and paint: look for mismatched colors, overspray, or uneven panel gaps signaling prior collision repair.

– Rust: surface spots may be cosmetic; structural rust near suspension, frame rails, or brake lines can be costly.

– Glass and lights: check for windshield chips, headlight haze, and working turn signals, brake lights, and reverse lights.

– Tires: tread depth should be even across all four; uneven wear can indicate alignment or suspension issues.

Under the hood, pull the dipstick and observe oil color and level; milky residue can indicate coolant mixing with oil. Inspect coolant, brake fluid, and transmission fluid for proper levels and clarity. Look for leaks along hoses, around the valve cover, and under the car after it’s been parked. Belts should be free of cracking; filters should not be excessively dirty. If possible, plug in an OBD-II scanner to check for stored or pending codes; a simple tool here can save hundreds of dollars later.

Test-drive procedure:

– Start the engine cold; note how quickly it fires and settles to idle.

– Listen for knocking, ticking, or belt squeals, and observe exhaust smoke color at start-up.

– On the road, test smooth acceleration, straight-line tracking, and braking without vibration or pulling.

– For automatics, ensure shifts are timely and smooth; for manuals, check clutch engagement and synchro health.

– Turn the wheel fully left and right in a parking lot to detect clicking or whining from axles or power steering.

– Operate climate controls, infotainment, power windows, locks, mirrors, and safety systems to confirm functionality.

Finally, schedule an independent pre-purchase inspection. A seasoned technician can spot frame repairs, hidden leaks, worn suspension components, and upcoming maintenance like brakes or a timing component service. The fee is modest compared to the cost of a hidden issue. If the seller resists an inspection, consider it a warning. Good cars welcome scrutiny.

Pricing, Valuation, and Total Cost of Ownership

Arriving at a fair price is part math, part market reading. Start by collecting at least six comparable listings within a reasonable radius, matching year, trim level, mileage, and condition. Note differences in options and ownership history. If the vehicle has recent high-value maintenance—new tires, brake service, or a fresh battery—it can justify a small premium. Conversely, overdue items reduce the offer you should make.

Adjust for the following:

– Mileage: compare to the regional norm; unusually low mileage boosts value, while high mileage lowers it.

– Condition: clean titles and documented service records typically command more.

– Options: advanced safety tech, tow packages, or premium audio can add value for the right buyer.

– Location and season: all-wheel traction tends to fetch more in snow-prone areas during winter; convertibles can be more desirable in warm months.

To build your offer, calculate a target range rather than a single number. One approach is:

– Establish a fair-market median from your comps.

– Subtract estimated reconditioning and deferred maintenance you’ll handle in the first year.

– Subtract a negotiation buffer to account for unknowns.

Total cost of ownership (TCO) keeps you honest. Estimate annual fuel expense using your expected miles and the car’s real-world economy. Add insurance quotes, local taxes and registration, and routine maintenance. Plan for wear items: tires ($500–$900 for a typical set), brakes ($300–$700 per axle depending on parts quality), and a major fluid service if due. Some vehicles have scheduled timing component service around 60,000–100,000 miles; ignoring it can be far more expensive than doing it on time. Depreciation still applies to used cars, but at a slower pace once the steep early years have passed.

By translating features and condition into dollars, you remove emotion from the equation. If the numbers don’t cooperate, you can walk away with confidence—because there will always be another listing.

Negotiation, Paperwork, and Post-Purchase Confidence

Negotiation rewards preparation. Arrive with printed comps, inspection notes, and your financing plan. Open respectfully with a data-backed offer rather than a vague “What’s your lowest?” If the seller counters, focus on facts: upcoming tires, a weak battery, or a weeping shock absorber are not opinions. Keep the conversation on the out-the-door price, which includes all taxes and fees, so there are no end-stage surprises.

Tactics that keep the process smooth:

– Separate the discussions: price of the car, trade-in value, and financing should be isolated.

– Use silence: make an offer, wait, and avoid bidding against yourself.

– Be willing to leave: more inventory and time often favor the buyer who can walk away.

– Set a limit: decide your stop point at home and stick to it at the lot or meeting.

Paperwork is the foundation of ownership. For private-party sales, ensure you have a properly endorsed title, a bill of sale with names, VIN, price, and date, and any required odometer disclosure. Some regions require an emissions or safety inspection before transfer; others allow a grace period. Confirm lien release if the seller had a loan. For dealer purchases, review the buyer’s order carefully; query documentation fees and add-ons you didn’t request, and decline any product you don’t value. Always verify that the VIN on the documents matches the vehicle.

Payment safety matters. Meeting at a bank branch allows secure transfer via cashier’s check and immediate verification. Avoid large cash transactions, wire transfers to unknown parties, or third-party links that feel rushed. Match the seller’s ID to the name on the title. If something seems off—a rushed timeline, evasive answers, or inconsistent stories—listen to that instinct.

After the purchase, set a baseline service: change engine oil and filters, replace cabin and engine air filters if dirty, top off fluids, and scan for any codes. Record your starting mileage and date, and save every receipt. Organize a spare key, floor mats, and any missing manuals. Register the vehicle and update insurance promptly to stay compliant. With the paperwork filed, the fluids fresh, and your maintenance plan scheduled, you can enjoy the satisfying feeling that comes from a well-researched, well-priced, and well-negotiated used car.